"If you want to be faithful to someone or something, you have to start by being faithful to yourself." - Paulo Coelho

FRIDAY, MARCH 09, 2018

Printable Copy or Audio Version

Morning Summary: U.S. stocks are seeing some minor gains as the market seems little fazed by new tariffs on steel and aluminum imports. The move had been widely advertised but there does seem to be a sense of relief on Wall Street that the White House chose to keep Canada and Mexico exempt from the increased tariffs. From what I understand, the tariffs go into effect in 15 days. As for today, investors are anxious to see the February Employment Situation which is expected to show the U.S. economy added +205,000 jobs in February and the unemployment rate could dip to 4.0%. Another important component of the report will be the change in hourly earnings. If hourly earnings jump higher, there will be more talk and concern about inflation. Other key data due out today include Wholesale Trade and the Baker-Hughes Rig Count. Keep in mind, the U.S. oil rig counts has rebounded back to 800, after dipping to 318 just two years ago. At our peak, mid-October of 2014, data showed we had 1,608 rigs online, so we still have a ton of room to bring on more rigs. Also today we will hear from Chicago’s Charles Evans, who will be on CNBC’s later this morning, then following up with an interview on Bloomberg Markets around lunchtime. After his television appearances, he’ll deliver a speech on current economic conditions and participate in a Q&A at New York’s Manhattan Institute. Boston Fed President Eric Rosengren is also due to give a speech in Springfield, Massachusetts, on the U.S. economy and monetary policy. Turning to next week, economic data will be in sharp focus with several highly anticipated releases on the calendar. The highlights include the Consumer Price Index, Producer Price Index, Housing Starts and Consumer Sentiment. No Fed officials are on the calendar as they will be entering the “black out” period before the next FOMC monetary policy meeting on March 20-21. Keep in mind, it’s widely expected the Fed will raise interest rates at this meeting and fears about how many more - and by how much - could be exacerbated depending on the degree of inflation pressures reflected in the CPI and PPI reports. Also on the radar next week will be updated Chinese data, including Fixed Asset Investments, Industrial Production and Retail Sales. In Washington, Congress will be tackling legislation that would loosen Dodd-Frank financial regulations. The reforms are viewed as beneficial to banks, who have long complained that complying with the many Dodd-Frank rules are overly costly. Behind closed doors, Congressional leaders will also continue working to hammer out appropriations needed to pass a spending bill before the March 23 deadline to avert a government shutdown. The market seems to be weathering the storm of political headlines and may soon regain its upward momentum. I'm staying a patient bull...

Trouble viewing the report? CLICK HERE to view in browser. Some folks have been having problems using old versions of Microsoft Outlook. This is our temporary solution until Microsoft provides a patch or you are able to upgrade to the newest version of Outlook. Call the office at 816-322-5300 if you are still having problems.

Tariffs Are Just A Small Piece Of The U.S.-China Trade Puzzle: President Trump yesterday unveiled his official plan to impose a 25% tariff on steel imports and a 10% tariff on aluminum imports. As the White House had hinted earlier in the week, Canada and Mexico are exempt from the tariffs, though that could change depending on the outcome of NAFTA renegotiations and upcoming talks surrounding security ties. Other countries may also be exempt but they will have to formally apply. Trump explained that the new policy is “flexible” and can be adjusted as the White House sees fit depending on various factors, including whether the country treats the U.S. “fairly” on trade. There is another ongoing trade development that seems to have been overshadowed by the tariffs drama, and one that might actually be even more significant. Ultimately, analysts say the steel and aluminum tariffs will not have that big of an impact on China, which most insiders view as the most worrisome country in the event of a trade war. Interestingly, the Trump administration has asked China to submit a plan that would cut the annual U.S. trade deficit with the country by $100 billion. Sources told The Wall Street Journal that the idea was presented to Liu He, the main architect of China’s economic policy, when he was in Washington last week. Mr. Liu was apparently receptive to the idea and even said such a move would be in China’s best interest. President Trump wants China to open more markets to U.S. products and eliminate widespread subsidies for state-owned firms. At the same time, the Trump administration is reviewing allegations of Chinese theft and expropriation of American intellectual property. If the White House finds them to be valid in the coming months, the U.S. could impose broad investment penalties against China. That in turn could prompt retaliation from China which is likely to be targeted at U.S. tech companies. Bottom line, the trade issues are far from settled! (Sources: Wall Street Journal, Yahoo Finance)

Home Flippers Pile Into the U.S. Market: Property investors were bullish on the U.S. housing market in 2017, flipping more homes than in any year since 2006, when the real estate bubble that helped upend the global economy was still inflating. Investors flipped more than 207,000 single-family houses and condos in the U.S. last year, Attom Data Solutions said in a report, which defines flips as sales that occur within 12 months of the last time the property changed hands. More than 138,000 investors flipped a home last year, the most since 2007. Today’s home flippers appear to be more conservative than bubble-era investors. The average flip generated gross returns of 50 percent in 2017, compared to 28 percent in 2006. Thirty-five percent of flippers financed their acquisitions last year, the highest share since 2008 but far lower than the 63 percent who used loans in 2006. Still, red flags show up in local markets. Flippers in Austin, Texas; Santa Barbara, California; and Boulder, Colorado, earned gross returns of less than 25 percent (which don’t include the cost of renovating the homes), suggesting that investors in some markets are depending on slim margins. (Source: Bloomberg)

Who Owns Who On The Web? In the brick and mortar world, decades of consolidation has led certain conglomerates to wield massive amounts of control in the banking, consumer goods, alcohol, and auto sectors. And although the internet is incredibly vast in scale and much newer, it’s also heading in a similar direction. As a result, it’s not unusual to see behemoths like Facebook, Alphabet, and Amazon leveraging their size, networks, and market leading positions to buy up competitors while also making other strategic acquisitions. This ongoing consolidation has created a vast web of subsidiaries, providing each parent organization with additional insurance in maintaining their position at the top of the digital food chain. The graphic below shows the companies or websites that are owned by the bigger fish. They fall into two categories, generally: 1. Gobbling up the competition, like Expedia for example. They now own fellow travel sites Travelocity, Hotels.com, Trivago, Orbitz, Hotwire, and CarRentals.com. 2. Strategy and tactics via things such as future proofing, apparent synergies and filling a weakness with their acquisitions. A good example is Facebook’s acquisition of Oculus, which allows the social network giant to enter into the VR business. Click the graphic for a larger view. (Source: Visual Capitalist)

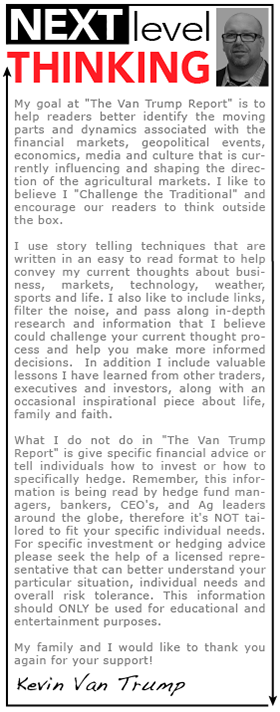

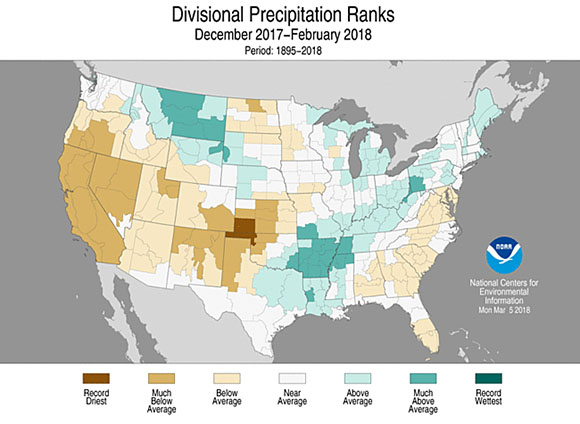

Weather across the Corn Belt is seeing cold, dry, breezy weather cover most of the region. Flooding generally continues to subside, except along some larger rivers. For example, lowland flooding persists along the Wabash and Illinois Rivers, and in the lower Ohio Valley. On the Plains, dry weather is prevailing. Warmth has returned to the drought-stricken southern half of the High Plains, where a locally elevated wildfire threat exists. With the issuance of the latest U.S. Drought Monitor, dated March 6, exceptional drought D4 has made its first appearance in Oklahoma since May 5, 2015 and in Kansas since June 3, 2014. In the South, freeze warnings were in effect yesterday as far south as parts of Alabama and Mississippi. It's a different story in the Southeast as record-setting February warmth has left some fruits and early planted crops especially vulnerable to spring freezes. A late February USDA/NASS report form Georgia indicated that fruit trees had begun blooming early. Looking ahead, chilly weather will linger in the Southeast, with freezes possible again today in some locations. In contrast, warmth will continue to expand across the central and southern Plains, further stressing rangeland, pastures and winter grains. Dry weather will persist at least into early next week on the central and southern High Plains, but showery weather in the Northwest will shift southward during the weekend into California and the Southwest. In Argentina, forecasts are indicating showers this weekend, but again, rainfall is expected to remain well below normal in the major growing areas of Argentina over the next week, which will maintain significant stress on the corn and soybean crops. Beyond the next week, however, the forecast is trending wetter for parts of Argentina. The precipitation will likely do little to help corn yields, but could all for some improvements in soybean yields.

Drought Improves in Midwest, Worsens in Plains: The latest U.S. Drought Monitor shows drought coverage decreased slightly over the past week, with 30.5% of the contiguous U.S. now in drought, compared to 31.3% last week. The decrease in drought coverage mostly occurred across the northeastern Plains and far southeastern Plains. Drought coverage held steady across the central and southwestern Plains and an area of exceptional drought is now showering up across western Oklahoma and in Kansas. No improvement is expected across the western Plains over the next week.

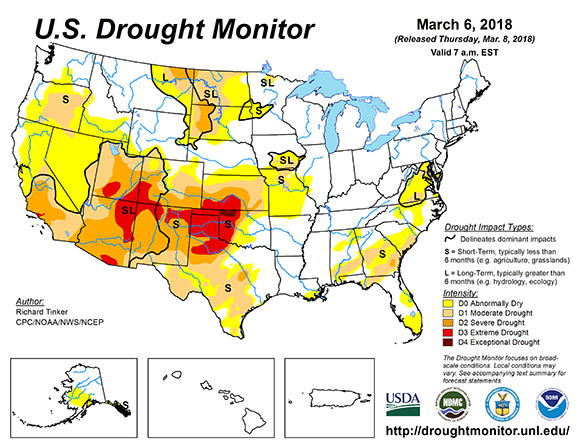

Driest Winter On Record: Look at Southwest Kansas and Northwest Oklahoma. The driest Dec. - Feb. on record.

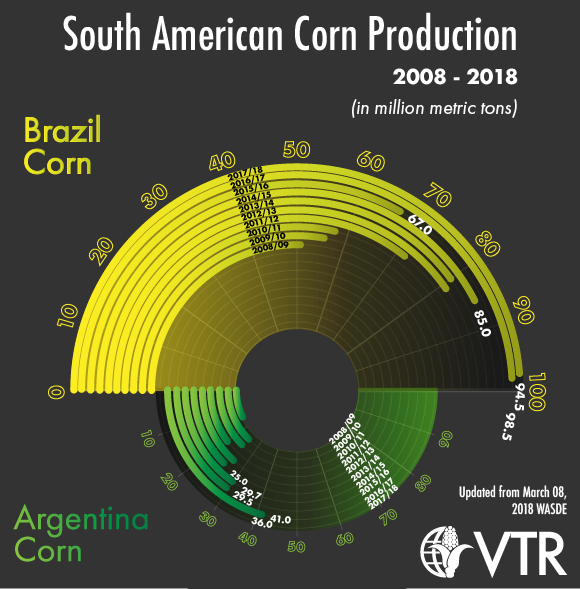

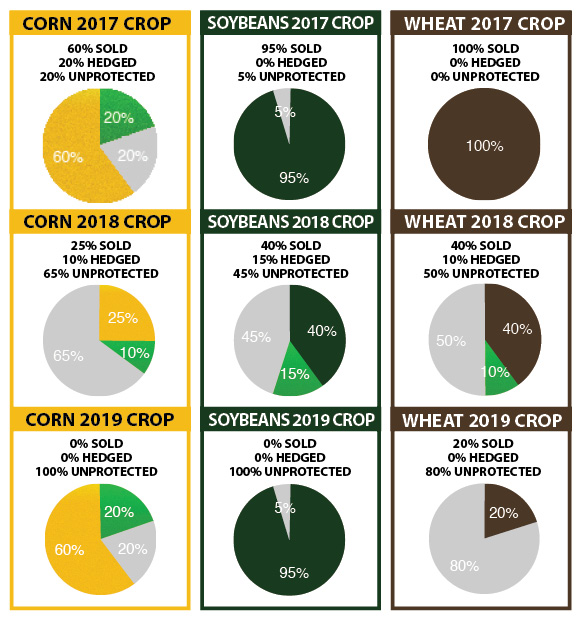

Corn bulls are happy to see the USDA adjust both domestic and global ending stocks lower. Global corn production was left largely unchanged as gains for the European Union, India, and South Africa virtually offset reductions for Argentina, Brazil, and Russia. I was personally surprised to see the South African crop bumped higher, I was thinking it would be left "unchanged". I was also hoping to see the Brazilian crop estimate reduced a bit further, as it was only lowered from 95.0 down to 94.5 MMTs. The trade was thinking the Brazilian corn estimate would be lowered down to between 91 and 92 MMTs. It seems like the recent rally in domestic corn prices inside Brazil has prompted interest in planting more second-crop acres. Meaning perhaps Brazilian second-crop corn production won't get hit as hard as we were originally thinking. Weather inside Brazil obviously remains a major wild-card so we need to keep paying close attention. I still don't feel like the Brazilian producers are going to be spending a lot of money on inputs or throwing a lot at the crop. Therefore shaky or questionable weather could create more yield drag or complications than we would normally expect to see. The USDA pushed their Chinese corn import demand higher from 3.0 to 4.0 MMTs. Here at home, the USDA also made some bullish adjustment to the demand side of the balance sheet, raising exports by +175 million bushel and raising corn used for ethanol by +50 million bushels. Net-net, U.S. ending stocks were lower by -225 million bushels. Technically, the old-crop JUL18 contract has pushed above psychological resistance at $4.00 per bushel, the first time we've closed back above $4.00 since mid-August. The next level of nearby resistance seems to be in the $4.10 to $4.15 area, then up between $4.25 and $4.35. A move north of these levels would signal a clear longer-term breakout. On a continuation chart, we really haven't seen the front-end of corn trade above $4.44 since late-June of 2014. New-crop DEC18 corn closed above $4.10 for the first time since mid-August. The next level of nearby chart resistance seems to be in the $4.15 to $4.20 area. With the previous high of $4.29^4 posted back on July11th of last year. As both a producer and a spec, I continue to keep a bullish tilt.

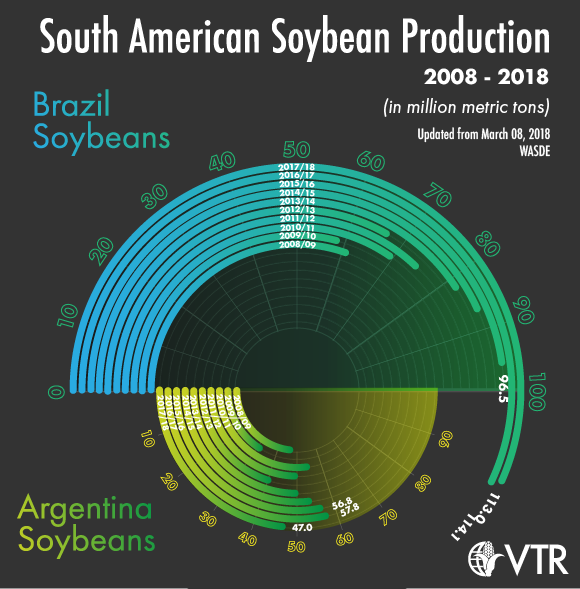

Soybean prices are pulling back a bit as traders get a somewhat mixed bag of data to digest from the USDA. Global stocks are reduced a bit, while U.S. ending stocks become more burdensome. Global oilseed production is forecast slightly lower. Soybean production is lowered on smaller crops in Argentina and Uruguay more than offsetting gains in Brazil, Russia, and South Africa. This month, USDA's production estimate for Argentina's 2017/18 soybean crop was reduced -7.0 million metric tons, with accompanying reductions in trade, crush, and stocks. The Brazilian crop is bumped higher by +1 MMTs from 112 to 113 MMT, but at the same time Brazilian exports are raised from 69.0 to 70.5 MMTs . In summary, world ending stocks for soybeans are reduced slightly, with lower stocks in Argentina and Brazil offsetting gains in the United States. Chinese soybean imports were left "unchanged" at 97.0 MMTs. Here at home, U.S. ending stocks are pushed higher by +25 million bushels to 555 million. The domestic crush estimate was raised higher by +10 million bushels but at the same time U.S exports were lowered by -35 million bushels. The season-average on-farm soybean price range forecast of $9.00 to $9.60 per bushel is unchanged at the midpoint.

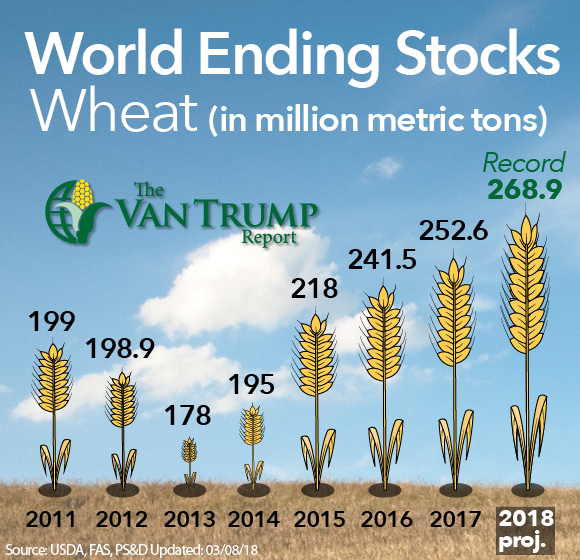

Wheat bears continue to receive confirmation of burdensome supply as both domestic and global ending stock estimates are higher than most in the trade were anticipating. The talk of record global production is little changed. The India wheat crop was actually raised higher from 98.4 to 98.5 MMTs, something I didn't really see coming. Kazakhstan wheat production was raised higher from 14.0 to 14.8 MMTs. On the flip side, the Chinese wheat crop was lowered just a hair from 130.0 to 129.8 MMTs. The crops in Australia, Canada, EU, Russia and Ukraine were left "unchanged". Russia exports were increased +1.5 million tons, partially offset by a -1.0 million-ton reduction for the EU. Russia exports are now projected at 37.5 million tons, up +35% from the previous year’s record and surpassing EU exports by 12.5 million. Here at home U.S. wheat exports were reduced by -25 million bushels to 925 million, pushing ending stocks higher by the same amount. Exports are lowered on reduced price competitiveness in some international markets. Hard red winter wheat and hard red spring wheat exports are reduced -15 million bushels and -10 million bushels, respectively.

|

> FAO Sees Rising Prices For Grain, Dairy Products: Rising world prices for staple grains and dairy products more than offset lower prices for vegetable oils, leading global food commodity prices up in February, according to the Food and Agriculture Organization of the United Nations (FAO) latest forecasts. The FAO Food Price Index averaged 170.8 points in February, up 1.1% from the previous month and now just 2.7% below its year-ago level. “Global stocks of wheat and coarse grains are both poised to hit record levels in the current marketing year, of 272.7 million tonnes and 309.8 million tonnes, respectively,” according to FAO’s Cereal Supply and Demand Brief. The FAO lowered its estimated worldwide wheat harvests this year, while noting that inventory levels are poised to hit a record high. It also estimates global supply conditions for the main cereals remain strong and has increased its forecast for end-of-season stock levels by 14 million metric tons. With harvesting of last year’s cereal crops now almost complete, FAO raised its global cereal production estimate for 2017 to 2.642 billion metric tons. The FAO issued its first 2018 global wheat production forecast of 744 million metric tons. “While above average, that would represent the second annual dip, reflecting lower anticipated yields in the E.U. and Russia,” the FAO said. (Source: World Grain)

> President Will Not Attend Next RFS Meeting: The White House has made preliminary plans for a meeting on Monday between rivals in the corn and oil industries to discuss potential changes to the nation’s biofuels policy, two sources familiar with the planning told Reuters. Unlike previous meetings on the issue, President Donald Trump will not be in attendance, the sources said on Thursday, though agency leaders and executives from the oil and corn industry will participate and key lawmakers may also attend. The meeting is the latest in a series of talks between Big Corn and Big Oil arranged by the White House since late last year amid rising concern over the U.S. Renewable Fuel Standard. Last week, Trump supported a two-step approach to reducing credit costs. That had the backing of refiners but faced resistance from the corn industry, which supports the current form of the law. (Source: Reuters)

> China 2017-18 Corn Demand Seen Higher Due To Industry Use: China revised higher its forecast for 2017-18 corn consumption to 223.6 million metric tons from a previous estimate of 222 million. Rising industry demand was cited as the reason behind the move higher. Total industry consumption was revised up to 64.8 million metric tons from a previous 63.3 million.

> Slowing French Wheat Exports Raise Risk Of Further Forecast Cut: There is starting to be more talk about another government shutdown. Some lawmakers have indicated that the government spending deal currently in the works may be derailed by Democrats that are taking a hard stand on DACA. From what I understand Congress must pass fiscal 2018 appropriations by March 23 to avoid a government shutdown. (Source: Reuters)

> Brazil At No Risk Of New Bans On Meat: Brazil does not face any risks of countries instituting new bans on Brazilian meat imports after the latest phase of the "Weak Flesh" investigation into companies accused of committing fraud to avoid safety checks, Agriculture Minister Blairo Maggi said. Federal police announced a new phase of the probe this week, issuing dozens of arrest and seizure warrants, and arrested the former chief executive officer of top chicken exporter BRF SA. (Source: Reuters)

> Possible Deal To Fix Tax Incentives For Co-ops: Many weeks after the problem was discovered, lawmakers have reached a final agreement to fix a section of the new tax law that created huge financial incentives for farmers to sell their products to agriculture co-ops. The deal was circulating among lawmakers and industry stakeholders, according to Sen. John Thune. The senator, who holds the third-highest ranking Republican leadership post, told reporters that the legislative language is done and just needs sign off from key negotiators before being shared publicly. The tentative agreement is expected to be included in the fiscal 2018 omnibus appropriations package that Congress must pass before March 23 to keep the government open. "If this drags out any longer, it will create a lot of problems," Thune said. (Source: Politico)

> China’s CNPC Buys 30% Stake In Brazilian Trading Company: CNPC's international unit, PetroChina International Co, has signed a contract to acquire a 30% stake in Brazilian oil products trading company TT Work. This will help distribute CNPC's oil products in Brazil as TT Work needs to import oil products. Private company TT Work, the fourth largest oil products distributor in Brazil, now has about 13 storage facilities which serve around 2,200 gasoline stations in the country, CNPC said. Brazil is one of the biggest oil product consumers and importers in Latin America. (Source: Platts)

> Kraft Heinz Launches Incubator For Disruptive Brands: Kraft Heinz Co. announced the launch of Springboard, a platform for nurturing, scaling and accelerating growth of disruptive U.S. brands in the food and beverage space. The move follows a similar initiative announced last month by Tyson Foods. Kraft said its Springboard platform seeks opportunities to develop brands within one of four pillars: Natural & Organic, Specialty & Craft, Health & Performance and Experiential brands. Springboard is also launching an incubator program focused on developing food and beverage startups at a pre-valuation stage in a dynamic 16-week program in Chicago. Springboard will accept applications now through April 5 for first-to-market startups. Companies selected to participate will have the opportunity to receive financial support to build brands and guidance to raise additional funding, Kraft said. (Source: MeatingPlace)

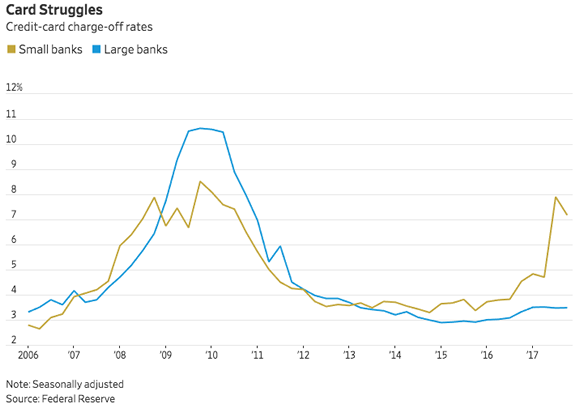

> Credit-Card Losses Surge at Small Banks: Small banks have been fighting for a bigger piece of the credit-card market in search of higher returns. Now, they’re contending with rising losses. Missed payments on credit cards at small banks have risen sharply over the past year, a sign that their cardholders are taking on more debt than they can handle. Their charge-off rate, or the share of outstanding card balances written off as a loss after consumers failed to pay, hit 7.2% in the fourth quarter, up from 4.5% a year ago, according to Federal Reserve data. But they’ve especially surged at smaller banks, those outside the 100 largest by assets that have less than around $10.4 billion in assets. There, the average charge-off rate is near an eight-year high, while the 3.5% loss rate at large banks remains well below the 10.6% seen in 2010. (Source: Wall Street Journal)

|

Central Kansas - We had a good year in 2017 with our irrigated acres seeing 200bpa corn and 50's for beans. Corn usually averages 190bpa and it was nice to have the extra bushels to sell. Things are really bad for our winter wheat, we have quite a bit of variation throughout our fields. If we do not get some rain in the next two weeks things will get bad. It is trying to green up but it cannot overcome the lack of moisture. We have taken advantage of the prices and sold half of our new corn crop and two-thirds of our new beans, both at profitable levels. It was an easy decision with all the uncertainties that are hanging over our heads.

Westcentral Ohio - We are chomping at the bit to get into the fields which will happen around late April or after. We can see some big snow events even at that time of year. We have purchased our anhydrous but have heard it was almost $200 cheaper in another state. Still trying to figure that out. We had an average year with 140 - 150bpa corn and only in the low 40's for beans. We like to do bean on beans for three years then rotate. We are seeing a lot of distressed sales out our way with prices in the $8,000 - $9,000 area. Things are getting very tight and it is starting to show. Some of the crazy rents are as high as $350 but most are in the $160-$250 area.

Central Saskatchewan - The temps are freezing up here and there is a little snow cover on the ground. We grow canola and a bunch of pulse crops and had a very good year last season even though things were a little drier than we would have liked. Things are not getting any better as there has not been any decent precipitation lately. The snow cover isn't enough to matter and we are hoping it doesn't warm up to fast causing the little bit of moisture we have to run off the frozen tundra. If all goes well we will start planting in early May.

|

Europe Struggles To Stem Biodiesel Import Flood: Rising biodiesel imports from Argentina and an expected surge in shipments from Indonesia threaten to cripple output in the European Union, the world’s top producer of the renewable fuel. The European Union slashed import duties on Argentine biodiesel last September after Buenos Aires mounted a successful challenge at the World Trade Organization, weeks after the United States imposed steep duties on the fuel. The bloc is now considering whether to cut duties on Indonesian biodiesel. Argentine soybean-based fuel is now entering the EU at much lower prices than rapeseed oil, the main material used by European producers, who say they cannot compete and in some cases are being pushed to the verge of bankruptcy. Between August last year and January, 852,000 tonnes of biodiesel - around four times the capacity of a large EU plant - worth $617 million, were exported from Argentina to the bloc, customs data showed. Earlier in 2017, nearly all exports were heading to the United States. Read more HERE.

Everyone Is Going through Something: “So for 29 years, I thought about mental health as someone else’s problem. Sure, I knew on some level that some people benefited from asking for help or opening up. I just never thought it was for me. To me, it was a form of weakness that could derail my success in sports or make me seem weird or different. Then came the panic attack.” The Cleveland Cav's Kevin Love opens up about his own struggles and the need for creating a better environment for talking about mental health. Check it out HERE.

Home Depot To Donate $50 Million To Train Construction Workers: Home Depot announced Thursday that it will donate $50 million to train 20,000 people as construction workers over the next decade, helping efforts to ease a dire shortage that's curtailing home building and driving up house prices. "It's important that we support the trades," Home Depot CEO Craig Menear said in an interview. "Not only do we sell product to professionals like plumbers and electricians," but the company also partners with service providers that install kitchen flooring, hot water heaters and other equipment in consumers' homes. Read more HERE.

A Year In Space May Have Permanently Changed Astronauts DNA: When NASA astronaut Scott Kelly stood up last March after spending a year in space, he was two inches taller. The engineer and veteran of four space flights is part of a long-term NASA study that aims to figure out how being in space changes our bodies and brains. Scott Kelly is uniquely positioned to give NASA key insight into these changes because he is both an astronaut and a twin. For its research, NASA is comparing Scott Kelly's DNA with the identical DNA of his twin brother, Mark Kelly. Mark stayed on Earth for Scott's 340-day stint aboard the International Space Station, giving NASA the rare opportunity to compare how being in space affected his genes. Scott's newfound height turned out to be only a temporary result of his spine being physically stretched in a gravity-free environment, and not a tweak to his genes. But it's just one of the many alterations the researchers have documented so far. Deep within Scott's DNA, they are finding a range of tweaks that are not present in his brother Mark. While some were temporary and seemed to occur only while he was in space, others were long-lasting. Read more HERE.

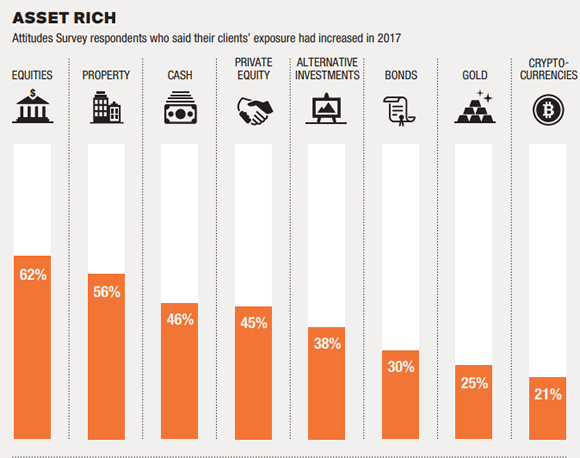

Here’s How Many Of The Worlds Ultra-wealthy Are Increasing Cryptocurrency Investments: What are the world’s uber-rich doing when it comes to cryptocurrencies? A growing number of high- net-worth individuals are attracted to them. More than one in five — 21% — of respondents in an annual survey of wealth advisers and private bankers said clients had increased their investments in cryptocurrencies in 2017, according to Knight Frank’s 2018 edition of its Wealth Report. The survey is based on responses from more than 500 private bankers and wealth advisers who collectively represent about 50,000 people with a combined wealth of more than $3 trillion. Despite all the conversation around cryptos, the ultrarich still prefer stocks and property over everything else. Some 62% of respondents said their clients had increased their exposure to equities in 2017, while 56% said clients increased their exposure to property. More details available HERE.

|

WalMart’s New Tech Could Save $2 Billion In Food Waste

WalMart is in the process of developing a new technology that can predict the spoilage date of fruits and vegetables. They initially launched the tech, called Eden, in January of last year at 43 of its food distribution centers. Walmart say it has saved the company about $86 million so far. Once the system is implemented company wide, WalMart estimates it will save the company more than $2 billion over the next five years by reducing food waste. Eden inspects produce in order to identify products that don’t meet USDA or Walmart quality standards. This is possible thanks to an algorithm that takes into account ALL USDA and WalMart standards, along with over 1 million photos used for comparison. Over time, the system becomes ever more accurate and is expected to eventually be able to forecast the exact date a fruit of vegetable will begin to spoil by factoring in thinks like the temperature of where its being stored. Parvez Musani, vice president of supply chain technology for Walmart, explains that in the future, Eden will even be able to recalculate the freshness factor of produce en-route on container trucks, and re-route the shipment if temperatures exceed acceptable ranges. To monitor temperature, Walmart will attach tracking devices to cases of produce as they travel on trucks between farms, distribution centers, and stores. WalMart has also begun deploying the technology to farmers who can operate Eden on their smartphones. Producers take a picture of food being prepared for shipment and the Eden system can identify any items that are below quality standards. WalMart has filed two patents for the new ”freshness technology”, which the company believes will exponentially optimize its shipping and rotation of fresh produce, in turn reducing food waste. Eden is WalMart’s own in-house system, but they aren’t the only technology being developed to fight food waste along the supply chain. Verigo has a system called Pod Quality. The start-up says the system gives growers, shippers and retailers “actionable data to optimize post-harvest, inventory rotation and routing decisions. According to the United Nations, over $7 billion worth of fresh products shipped in North America spoil in the back of a truck or in a warehouse before reaching a consumer. (Sources: Forbes, Business Insider)

Daylight Savings Time Begins This Weekend

Daylight saving time starts its annual eight-month run at 2 a.m. this Sunday, March 11. My grandmother always taught me, "spring forward and fall backwards." Meaning move the clocks forward in the Spring and backwards in Fall. This time adjustment was first enacted by the federal government March 19, 1918, during World War I, as a way to conserve coal. Love it or hate it, if you live in the U.S. it’s an annual ritual you have to participate in. Unless you live in Arizona or Hawaii, which don’t recognize the time-warp. In fact, no state is legally required to recognize Daylight Saving Time. The only Federal law regarding our clocks is the Uniform Time Act, which established a system to guarantee the time change was uniform across the country. For one, state and local governments didn’t always start or end DST on the same dates! The other major inconsistency up until then had been that some cities and towns within the same state did not to recognize DST. As you can imagine, these inconsistencies were a nightmare logistically for any sort of interstate commerce, especially for transportation systems. At they time Congress was trying to justify a uniform time law, they released a report that showed on a 35-mile stretch of highway (Route 2) between Moundsville, W.V., and Steubenville, Ohio, every bus driver and his passengers had to endure seven time changes! So now, DST participation is optional only for entire states. Daylight Savings Time begins on the second Sunday of March and ends the first Sunday of November. In our tech-centric modern world, most of our time tracking devices don’t need to be physically adjusted. Most of them automatically update themselves. If they are connected to the internet, they do this via what’s called the National Time Protocol (NTP), which is designed to synchronize the time of all participating devices within a few milliseconds of Coordinated Universal Time. Basically, every time your device connects to the internet, it “checks in” with this system and updates the time. That still leaves us with all sorts of clocks that need to be manually adjusted. Another informal ritual that many Americans have adopted is an annual reminder to change the batteries in your smoke detectors the same time you change your clock.

How One Man Can Make A Huge Difference

In 1978, Jadav Payeng began planting a tree every day for 37 years — the results are stunning. I encourage you to watch this extremely short video that was recently sent my direction. Good stuff! Click HERE

|

|

1954, Cold War - Senate Republicans level criticism at fellow Republican Joseph McCarthy and take action to limit his power. The criticism and actions were indications that McCarthy’s glory days as the most famous investigator of communist activity in the United States were coming to an end. A Republican senator from Wisconsin, McCarthy had risen to fame in early 1950 when he stated in a speech that there were over 200 known communists operating in the U.S. Department of State. Various other charges and accusations issued forth from McCarthy in the months and years that followed. Although he was notably unsuccessful in discovering communists at work in the United States, his wild charges and sensational Senate investigations grabbed headlines and his name became one of the most famous in America. Republicans at first embraced McCarthy and his devastating attacks on the Democratic administration of President Harry S. Truman. However, when McCarthy kept up with his charges about communists in the government after the election of Republican Dwight D. Eisenhower in 1952, the party turned against him. Eisenhower himself was particularly disturbed by McCarthy’s accusations about communists in the U.S. Army. On March 9, 1954, Republican Senator Ralph Flanders (Vermont) verbally blasted McCarthy, charging that he was a “one-man party” intent on “doing his best to shatter that party whose label he wears.” McCarthy’s days as a political force were indeed numbered. During his televised hearings into the U.S. Army later in 1954, the American people got their first look at how McCarthy bullied witnesses and ignored procedure to suit his purposes. By late 1954, the Senate censured him, but he remained in office until his death in 1957. His legacy was immense: during his years in the spotlight, he destroyed careers, created a good deal of hysteria, and helped spread fear of political debate and dissent in the United States. 1954, Cold War - Senate Republicans level criticism at fellow Republican Joseph McCarthy and take action to limit his power. The criticism and actions were indications that McCarthy’s glory days as the most famous investigator of communist activity in the United States were coming to an end. A Republican senator from Wisconsin, McCarthy had risen to fame in early 1950 when he stated in a speech that there were over 200 known communists operating in the U.S. Department of State. Various other charges and accusations issued forth from McCarthy in the months and years that followed. Although he was notably unsuccessful in discovering communists at work in the United States, his wild charges and sensational Senate investigations grabbed headlines and his name became one of the most famous in America. Republicans at first embraced McCarthy and his devastating attacks on the Democratic administration of President Harry S. Truman. However, when McCarthy kept up with his charges about communists in the government after the election of Republican Dwight D. Eisenhower in 1952, the party turned against him. Eisenhower himself was particularly disturbed by McCarthy’s accusations about communists in the U.S. Army. On March 9, 1954, Republican Senator Ralph Flanders (Vermont) verbally blasted McCarthy, charging that he was a “one-man party” intent on “doing his best to shatter that party whose label he wears.” McCarthy’s days as a political force were indeed numbered. During his televised hearings into the U.S. Army later in 1954, the American people got their first look at how McCarthy bullied witnesses and ignored procedure to suit his purposes. By late 1954, the Senate censured him, but he remained in office until his death in 1957. His legacy was immense: during his years in the spotlight, he destroyed careers, created a good deal of hysteria, and helped spread fear of political debate and dissent in the United States.

1981, Nuclear Accident - A nuclear accident at a Japan Atomic Power Company plant in Tsuruga, Japan, exposes 59 workers to radiation on this day in 1981. The officials in charge failed to timely inform the public and nearby residents, endangering them needlessly. Tsuruga lies near Wakasa Bay on the west coast of Japan. Approximately 60,000 people lived in the area surrounding the atomic power plant. On March 9, a worker forgot to shut a critical valve, causing a radioactive sludge tank to overflow. Fifty-six workers were sent in to mop up the radioactive sludge before the leak could escape the disposal building, but the plan was not successful and 16 tons of waste spilled into Wakasa Bay. Despite the obvious risk to people eating contaminated fish caught in the bay, Japan’s Atomic Power Commission made no public mention of the accident or spill. The public was told nothing of the accident until more than a month later, when a newspaper caught wind of and reported the story. By then, seaweed in the area was found to have radioactive levels 10 times greater than normal. Cobalt-60 levels were 5,000 times higher than previous highs recorded in the area. Finally, on April 21, the Atomic Power Commission publicly admitted the nuclear accident but denied that anyone had been exposed to dangerous levels of radiation. Two days later, the company running the plant declared that they had not announced the accident right away because of Japanese emotionalism toward anything nuclear. The public also learned for the first time that, in an earlier incident at the same plant in January 1981, 45 workers had been exposed to radiation. 1981, Nuclear Accident - A nuclear accident at a Japan Atomic Power Company plant in Tsuruga, Japan, exposes 59 workers to radiation on this day in 1981. The officials in charge failed to timely inform the public and nearby residents, endangering them needlessly. Tsuruga lies near Wakasa Bay on the west coast of Japan. Approximately 60,000 people lived in the area surrounding the atomic power plant. On March 9, a worker forgot to shut a critical valve, causing a radioactive sludge tank to overflow. Fifty-six workers were sent in to mop up the radioactive sludge before the leak could escape the disposal building, but the plan was not successful and 16 tons of waste spilled into Wakasa Bay. Despite the obvious risk to people eating contaminated fish caught in the bay, Japan’s Atomic Power Commission made no public mention of the accident or spill. The public was told nothing of the accident until more than a month later, when a newspaper caught wind of and reported the story. By then, seaweed in the area was found to have radioactive levels 10 times greater than normal. Cobalt-60 levels were 5,000 times higher than previous highs recorded in the area. Finally, on April 21, the Atomic Power Commission publicly admitted the nuclear accident but denied that anyone had been exposed to dangerous levels of radiation. Two days later, the company running the plant declared that they had not announced the accident right away because of Japanese emotionalism toward anything nuclear. The public also learned for the first time that, in an earlier incident at the same plant in January 1981, 45 workers had been exposed to radiation.

1985, Adopt-a-Highway - The first-ever Adopt-a-Highway sign is erected on Texas’s Highway 69. The highway was adopted by the Tyler Civitan Club, which committed to picking up trash along a designated two-mile stretch of the road. The Adopt-a-Highway program really began the year before, when James Evans, an engineer for the Texas Department of Transportation, noticed litter blowing out of the back of a pickup truck he was following in Tyler, Texas. Concerned about the increasing cost to the government of keeping roadways clean, Evans soon began asking community groups to volunteer to pick up trash along designated sections of local highways. Evans got no takers for his idea; however, Billy Black, the public information officer for the Tyler District of the Texas Department of Transportation, took up the cause and organized the first official Adopt-a-Highway program, which included training and equipment for volunteers. After the Tyler Civitan Club’s sign went up on March 9, other groups volunteered to beautify their own stretches of highway. The program eventually spread to the rest of the U.S. and to such countries as Canada, Japan and New Zealand. Businesses, schools and churches are among the main organizations to participate in the Adopt-a-Highway (also known in some places as Sponsor-a-Highway) program. However, over the years, some Ku Klux Klan and neo-Nazi groups, along with other controversial organizations, have tried to become involved–and thereby receive signs along highways acknowledging their effort. After the state of Missouri rejected a Ku Klux Klan group’s application to join the program, the white supremacist organization charged that its free-speech rights were being violated. In 2005, the U.S. Supreme Court ruled that Missouri couldn’t prevent the KKK from participating. 1985, Adopt-a-Highway - The first-ever Adopt-a-Highway sign is erected on Texas’s Highway 69. The highway was adopted by the Tyler Civitan Club, which committed to picking up trash along a designated two-mile stretch of the road. The Adopt-a-Highway program really began the year before, when James Evans, an engineer for the Texas Department of Transportation, noticed litter blowing out of the back of a pickup truck he was following in Tyler, Texas. Concerned about the increasing cost to the government of keeping roadways clean, Evans soon began asking community groups to volunteer to pick up trash along designated sections of local highways. Evans got no takers for his idea; however, Billy Black, the public information officer for the Tyler District of the Texas Department of Transportation, took up the cause and organized the first official Adopt-a-Highway program, which included training and equipment for volunteers. After the Tyler Civitan Club’s sign went up on March 9, other groups volunteered to beautify their own stretches of highway. The program eventually spread to the rest of the U.S. and to such countries as Canada, Japan and New Zealand. Businesses, schools and churches are among the main organizations to participate in the Adopt-a-Highway (also known in some places as Sponsor-a-Highway) program. However, over the years, some Ku Klux Klan and neo-Nazi groups, along with other controversial organizations, have tried to become involved–and thereby receive signs along highways acknowledging their effort. After the state of Missouri rejected a Ku Klux Klan group’s application to join the program, the white supremacist organization charged that its free-speech rights were being violated. In 2005, the U.S. Supreme Court ruled that Missouri couldn’t prevent the KKK from participating.

|

Thurs. 3/08 - USDA Supply and Demand

Sun. 3/11 - Daylight Saving Time Begins

Tues.-Wed. 3/20-3/21 - FOMC Meeting

Thurs. 3/22 - Cold Storage

Fri. 3/23 - Cattle on Feed

Thurs. 3/29 - Quarterly Stocks and Prospective Plantings

Thurs. 3/29 - Quarterly Hogs and Pigs

Fri. 3/30 - Good Friday - Markets Closed

Mon. 4/2 - Weekly Crop Progress Begins

Thurs. 4/10 - USDA Supply and Demand

Wed. 4/11 - Minutes From 3/21 FOMC Meeting Released

Fri. 4/20 - Cattle on Feed

Mon. 4/23 - Cold Storage

Tues.-Wed. 5/1-5/2 - FOMC Meeting

Thurs. 5/10 - USDA Supply and Demand

Thurs. 5/17 - Farm Labor

Tues. 5/22 - Cold Storage

Wed. 5/23 - Minutes From 5/2 FOMC Meeting Released

Fri. 5/25 - Cattle on Feed

Mon. 5/28 - Memorial Day - Markets Closed

Tues. 6/12 - USDA Supply and Demand

Tues.-Wed. 6/12-6/13 - FOMC Meeting

Fri. 6/22 - Cattle on Feed

Fri. 6/22 - Cold Storage

Thurs. 6/28 - Quarterly Hogs and Pigs

Fri. 6/29 - Quarterly Stocks and Acreage

|

“I am a recent subscriber to Kevin’s newsletter, but I’m a long-time reader of many other high-profile marketing services. I am particularly impressed with the thorough manner in which Kevin evaluates every economic aspect, both nationally and internationally, that influences commodity prices. His analysis and conclusions are highly thought out and conveyed in layman’s terms so that the reader can comprehend the numerous and often complex interrelationships that impact the markets. Kevin is a real attribute to the agricultural sector.”

A.M., FDIC

“As a national federal farm policy administrator and commodity producer, I find it critical to keep updated with what is going on in the real world of agriculture and with the domestic and global markets. Of all the services I’ve have been privy to or have subscribed to over the past 20 years I’ve found in the past several months of engaging in your “Farm Direction” services to be the best perception and analysis of what is really happening in today’s world. Not only here in the United States, but across the globe as well. US farmers need this type of help and information to assist them in their daily efforts. I commend you for a job well done. Please let me know if I can ever be of any help or assistance to you in the future…”

L.T., Assistant Deputy Administrator for Farm Programs USDA

|

|

"Not To Trade, is often considered a good trading decision..."

"First Rule of HOLES: When you are in one stop digging..."

"Every looser in Vegas, always walks away from the table thinking he could have done better, the winners on the other hand leave while on top..."

"Bulls make money, Bears make money, but pigs get slaughtered..."

"The markets ability to remain irrational can often times last much longer than your ability to remain solvent..."

I'm more of a long-term player, therefore you will not see me give many short-term suggestions or trade ideas. One of my most important rules is that I always follow my long-term direction. Therefore, as long as I am "bullish" a market I will only play that particular market in one of three ways.

- Option #1 - Conservatively long.

- Option #2 - Aggressively long.

- Option #3 - Sitting on the sideline.

I never initiate a "short" position in a market that I am "bullish" longer-term, nor do I initiate a "long" position in a market I am "bearish" longer-term.

|

|